We know that you’re no stranger to the world of payment cards. From paying the bill at your favorite grocery stores to shopping for trendy outfits through online purchases, card payment has gained a lot of momentum over the years. Have you heard of Atome Card?

In today’s world, we simply cannot fathom the idea of having to live with payment cards – they’ve made our lives much easier.

One such payment card is the Atome Card – we’ll get into its details later in the article. Before getting into the details of the Atome Card, it would be wise if you grasped the specifics of card payments and card payment types.

What is card payment?

You must have come across the terms credit card payment or debit card payment, which begs the question, what is card payment? For the purpose of explanation, we’ll be referring to card payments as payment cards now.

Payment cards make up a part of a larger payment mechanism that various financial institutions issue to a customer. These financial institutions include banks as well. Through payment cards, these banks allow their customers to access the funds in their accounts and initiate payments through electronic transfers or ATMs.

In layman’s terms, card payments allow their customers to make payments by giving or scanning their card number to the merchant (or store). This way, just by swiping a simple card, you can pay for your purchases without having to submit any cash.

Types of Payment and Card Payment Types

The most common types of payment are as follows:

- Cash: You pay cash in exchange for goods/services.

- Cheques: Paper forms that process payments directly from the cheque holder’s bank account.

- Debit cards: You swipe your debit card to pay for your purchases.

- Credit cards: Very similar to debit cards, a credit card allows its users to defer payments while incurring a credit bill.

Different types of payment cards out there

There are six different card payment types that are out there.

- Credit cards

Credit card payments allow the user to spend up to a credit limit chaperoned by an interest-free period. Credit cards require the cardholder to compensate at least the minimum amount at the end of each month – interest is charged against any outstanding balances.

- Debit cards

Debit cards are payment cards issued by banks and other financial institutions that limit the debit cardholder to the amount of money that is in their banks.

- Charge cards

Charge cards necessitate the cardholder to pay an annual fee. These cards usually allow the cardholder a period of credit. Meaning that you have to pay your credit bills if you don’t want interest to levy on any outstanding balances.

- Business travel cards

Business travel cards function just like other business credit and charge cards and offer a convenient means for staff to pay for their business travel expenses.

- Prepaid cards

Prepaid cards are a card payment option that is already loaded with cash to pay for your expenses.

- Purchasing cards

Purchasing cards can only be used by large businesses, and public sector bodies and are designed to eliminate the need for paperwork and purchase orders.

What is Atome Card?

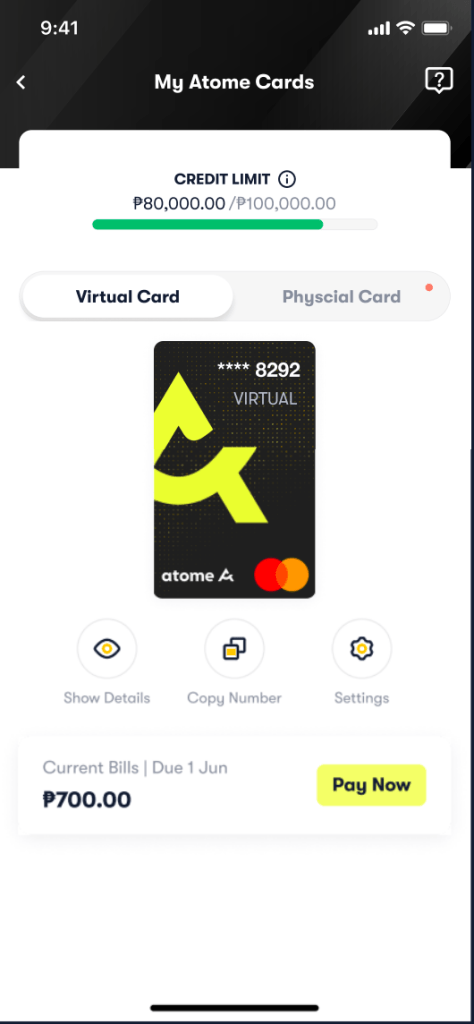

In its essence, Atome Card is a payment option that allows its users (or cardholders) to shop from a slew of shopping platforms where Mastercard is accepted as a means of payment. Diving into the specifics, when shopping from online stores, you can use Atome virtual card to pay. Correspondingly, you can use your Atome physical card to pay for your purchases at a physical store.

Atome Card is a card made with a joint and collaborative effort with Mastercard that comes with an assigned spending limit. This groundbreaking and revolutionary payment option has paved the way for Filipino customers to take a step ahead for Atome, its merchants, and its customers. This is because the Atome Card eliminates the need for a middleman.

The best thing about the Atome Card is that there is no prerequisite of minimum income, and it levies no annual fees.

Types of Atome Cards

There are two types of Atome Cards – Atome virtual card and Atome physical card. The virtual card can be used to pay for online purchases, whereas the physical card allows you to pay for your in-store purchases.

Why is Atome Card so popular in the Philippines?

The Atome Card offers its customers living in the Philippines awesome levels of choice, flexibility, and access to some outstanding products and services.

Through Atome Card Philippines, the company aims to cover a greater volume of customers and businesses by opening new avenues of possibility in the digital commerce sector. By paying for all their purchases through the Atome Card Philippines, Filipinos enjoy exclusive offers that only apply to the region, making this card payment service turn so many heads in the Philippines. Hence, the popularity of the Atome Card in the Philippines.

Moreover, there are no annual fees to scratch your heads over, and these cards don’t even require any minimum income thresholds to maintain!

The world is changing, and so are we. Today, traditional cash transactions are replaced by contemporary card payment transactions. By offering greater flexibility, choice, and convenience, payment cards are the deal today – and how can we discuss payment cards without talking about the Atome Card? It’s new; it’s fresh; it’s what you want! Step foot in the modern era through the Atome Card – you’re just a swipe away!